In today’s complicated financial world, making informed decisions isn’t just beneficial—it’s indispensable. By working behind the scenes, research analysts untangle intricate financial webs for their clients, turning mountains of raw data into valuable insights. Just consider how one multinational corporation avoided crippling liquidity issues thanks to Rosenberg Research’s targeted advice during its restructuring phase.

Moreover, precise data collection and advanced analytical tools form the bedrock of these invaluable recommendations. From parsing SEC filings to running complex Monte Carlo simulations predicting market trends, every step involves meticulous effort and specialized expertise. With such powerful methodologies at their disposal, it’s no wonder that trusting in skilled research analysts helps navigate even the most convoluted financial landscapes effortlessly.

How Research Analysts Assist with Complex Advisory

Research analysts play a pivotal role in addressing intricate financial challenges. Their deep knowledge and analytical prowess enable them to process vast data and guide clients toward informed decisions. By analyzing a company’s position within broader industry trends, analysts help shape future strategies.

The recommendations of an analyst are to streamline the restructuring process and mitigate liquidity risks, demonstrating the critical role of research in sophisticated financial decision-making.

Ongoing communication with analysts further refines strategies, helping clients navigate evolving financial landscapes with confidence.

Data Analysis and Information Gathering

At the core of a research analyst’s role is transforming raw data into actionable insights. This begins with gathering data from primary sources like company reports, SEC filings, and market data vendors. Analysts identify relevant trends and patterns, ensuring nothing critical is missed.

Next comes data cleansing, a crucial step where discrepancies are corrected and errors filtered out to ensure accuracy. Finally, using analytical tools such as Python and R, analysts perform advanced calculations to reveal key metrics, transforming clean data into valuable insights that inform complex advisory decisions.

Advanced Data Analysis Techniques

Research analysts use advanced methods like regression analysis and simulations to deepen their insights. For example, regression analysis helps analysts understand the relationship between interest rates and stock prices by examining historical data. Simulations, on the other hand, model risk and uncertainty, generating probability distributions of potential outcomes from random inputs.

These methods offer more robust financial forecasts—nearly 70% of forecasts using Monte Carlo yield better insights, enabling investors to navigate uncertainties with greater confidence. This rigorous analysis shapes more informed decision-making and strategic planning.

Strategic Investment Recommendations

Research analysts play a pivotal role in shaping strategic investment recommendations. Their primary goal is to help clients make informed decisions that align with their financial objectives and risk tolerance. By meticulously analyzing data and market trends, they curate investment strategies that spotlight emerging opportunities while helping navigate potential pitfalls.

Analysts often employ sophisticated financial models such as discounted cash flow (DCF) and the Efficient Market Hypothesis (EMH). The DCF model estimates the present value of future cash flows from an investment, providing crucial insight into its potential profitability. EMH supports the notion that all available information is already reflected in asset prices, which means analysts must be adept at distinguishing genuine market inefficiencies to identify potential investments.

Portfolio Management Support

A well-rounded investment portfolio is like a living organism; it requires continual adjustments and fine-tuning to thrive in changing market conditions. Research analysts play an essential role in providing the necessary support for effective portfolio management, ensuring investments stay on track with financial goals and risk tolerance.

Key Portfolio Management Services

One of the fundamental aspects of portfolio management is asset allocation. This involves selecting the right mix of asset classes—stocks, bonds, real estate, and alternative investments—to ensure a balance that aligns with the client’s risk tolerance and investment objectives. By analyzing market trends and economic data, analysts help clients make informed decisions about how much to allocate to each asset class based on their unique financial situation and goals.

Another vital service is performance evaluation. Analysts regularly assess portfolio performance against relevant benchmarks, providing clients with a clear picture of how their investments are performing. By understanding this performance metric, clients can gauge whether their investment strategy is yielding the expected results or if adjustments need to be made. Anomalies in performance can trigger deeper investigations into market sectors or individual assets that require further attention.

Lastly, there’s risk monitoring, which entails identifying potential risks that could jeopardize a client’s portfolio stability. In today’s unpredictable markets, having proactive measures in place is essential. Analysts utilize sophisticated tools to monitor these risks continuously and can recommend strategies to mitigate them, such as diversifying holdings or temporarily reallocating assets.

Clients have remarked that “continuous support from analysts has been instrumental in navigating volatile markets.” This highlights how personalized assistance from analysts proves indispensable at every stage of portfolio management.

The seamless integration of these services equips clients with both confidence and clarity in their investment pursuits. With a solid foundation established through these fundamental strategies, we can now explore how maintaining open lines of communication enhances these advisory relationships.

Effective Client Communication

Clear and effective communication is not merely a nicety; it’s the bedrock of successful partnerships between research analysts and clients. When analysts articulate complex financial analyses in a straightforward manner, it empowers clients to make informed decisions regarding their investments. The intricacies of market dynamics, asset valuation, and risk assessment can often overwhelm even seasoned investors. However, by breaking down these topics into simple concepts, analysts demystify finance for their clients.

An important aspect of this communication process starts with the initial consultation. During this phase, analysts gather crucial information about the client’s financial goals and risk tolerance. This isn’t just a one-and-done meeting; rather, it’s a foundational touchpoint where the analyst builds a relationship with the client. The insights gathered here guide future recommendations, ensuring they align with client priorities. Analysts should also strive to use language that resonates with each client individually, drawing on analogies or relevant experiences that make financial concepts relatable.

Regular, ongoing updates are another essential strategy. These updates keep clients informed about market movements and portfolio performance, reinforcing the idea that they are active participants in their financial journey.

Consistent communication is key—whether sharing weekly summaries or quarterly reports. Each piece of information provides valuable context and allows clients to understand both successes and challenges in their portfolios. For example, when an analyst shares performance figures alongside charts depicting market trends, it offers a broader understanding of how external events impact individual investments.

Leveraging Research Analysts for Complex Advisory Scenarios

In the face of global uncertainty and rapidly shifting markets, research analysts offer the analytical expertise and data-driven insights necessary to navigate complex advisory scenarios. From predicting the effects of geopolitical events to identifying new growth opportunities, their work enables advisors to craft strategies that protect assets, reduce risk, and maximize returns.

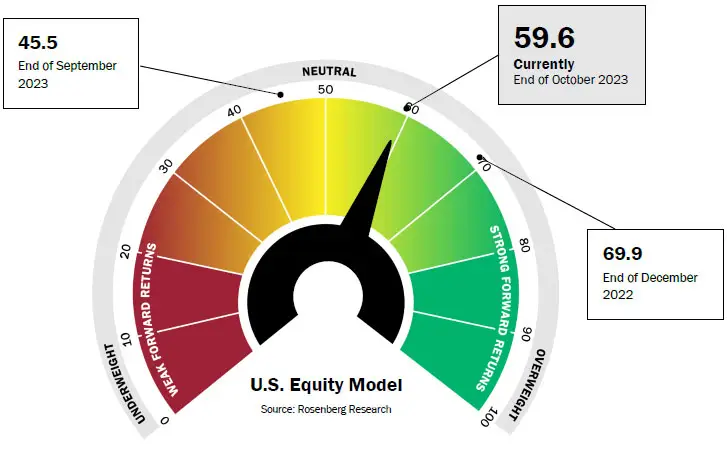

At Rosenberg Research, we specialize in providing the comprehensive macroeconomic analysis that advisors need to manage even the most complex financial situations.

Sign up for our free trial today to gain access to in-depth research and insights that empower your advisory decisions.