Data-driven macroanalysis offers financial advisors a comprehensive way to understand global economic trends by examining extensive datasets. Think of it as a high-powered telescope zooming in on the intricate workings of the world’s economic systems, revealing patterns and insights that traditional analyses might overlook. This approach empowers advisors to develop well-informed investment strategies, anticipate market shifts, and provide nuanced, value-adding advice to their clients. By harnessing this powerful tool, advisors are equipped to predict financial climates with greater accuracy, akin to having tomorrow’s economic forecast today. Prepare for an enlightening exploration filled with real-world applications and expert recommendations that will enhance your strategic financial planning.

Introduction to Data-Driven Macroanalysis

Data-driven macroanalysis equips financial advisors with the capabilities to explore and interpret vast datasets, transforming these into actionable insights for robust investment strategies. This method involves analyzing extensive data, such as historical stock market returns, GDP growth rates, inflation rates, and exchange rate fluctuations, to discern patterns and predict future economic behaviors.

This approach allows advisors to assess current economic conditions and predict future market movements with a higher degree of precision. It’s about making informed decisions bolstered by empirical data rather than mere speculation.

For example, by understanding the relationship between interest rate adjustments and stock market trends or by examining how shifts in unemployment rates affect consumer spending patterns, advisors can proactively adjust their strategies to better align with anticipated market conditions.

Data-driven macroanalysis is grounded in solid evidence and sophisticated analytical techniques. By incorporating this method, financial advisors can enhance the advice they provide to their clients, navigating through market volatility with greater assurance and strategic acumen.

At Rosenberg Research, we are committed to providing financial advisors with the tools and insights necessary to effectively utilize data-driven macroanalysis. Our platform offers real-world examples and expert guidance to help advisors not only understand but also implement this approach to elevate their service offerings and successfully steer their clients’ investments through complex economic terrain. Next, we’ll delve into the essential resources and tools that support financial advisors in adopting a data-driven approach to macroeconomic analysis.

Key Tools and Sources for Effective Macro Analysis

For financial advisors, staying informed through accurate economic indicators is pivotal for sound decision-making. Gross domestic product (GDP) growth is a prime economic indicator that measures the overall economic output and health. It offers insights into whether an economy is expanding or contracting, guiding investment decisions.

Moreover, unemployment rates reveal the percentage of the workforce that is jobless and actively seeking employment, reflecting the labor market’s strengths or weaknesses. Inflation rates, which measure the price increase of goods and services over time, also significantly influence investment strategies as they affect consumer purchasing power and economic stability.

Consumer confidence indices provide a snapshot of how optimistic or pessimistic consumers are regarding their financial circumstances and the general state of the economy, which in turn can drive market trends.

Additionally, the decisions and communications from central banks regarding interest rates and monetary policies are crucial for advisors, as they directly impact investment climates and financial markets.

Today’s financial advisors rely heavily on advanced tools to access and analyze these indicators. Platforms like Bloomberg Terminal. Bloomberg Terminal offers real-time financial data, tools for analysis, and news feeds, essential for advisors needing up-to-the-minute information.

With these resources, advisors can build a robust foundation for macroeconomic analysis, enabling them to offer strategic, data-driven advice to their clients.

Recommended Macroanalysis Strategies for Financial Advisors

Understanding the essential tools and sources equips financial advisors to delve deeper into effective strategies that can profoundly impact their decision-making regarding market trends and investment opportunities. Here are some foundational macro-analysis strategies that can enhance the services provided to clients:

Trend Analysis: Trend analysis is crucial in macroanalysis, involving the examination of long-term economic and market trends to predict future investment landscapes. By analyzing demographic shifts, technological progress, and changes in global trade patterns, financial advisors can identify upcoming opportunities and risks. For example, a rising trend in sustainable energy might prompt advisors to recommend investments in renewable energy sectors, whereas a decline in fossil fuel reliance might suggest divesting from traditional energy companies.

Correlation Analysis: Understanding the correlations between different economic variables and asset classes is vital for constructing diversified portfolios that withstand market fluctuations. This strategy involves examining how different asset classes react to economic changes. For example, if historical data shows that stocks and bonds typically move in opposite directions, advisors might balance client portfolios between these assets to reduce risk.

Scenario Analysis: Scenario analysis is a method where advisors forecast various plausible future economic scenarios to gauge their potential effects on investment portfolios. This approach allows advisors to prepare for adverse conditions by understanding how different scenarios could affect market conditions and asset values. For instance, scenarios may include drastic changes in interest rates or significant geopolitical events, helping advisors strategize defensive positions in portfolios that could mitigate potential losses.

Integrating these strategies into their practice enables financial advisors to offer nuanced, informed advice that aligns with their clients’ goals. These strategies not only aid in risk management but also help in identifying promising opportunities, thereby optimizing investment returns. This proactive approach to macroanalysis ensures that portfolios are well-prepared to navigate through both volatile and favorable economic phases.

By employing these sophisticated macroanalysis strategies, financial advisors can enhance their ability to guide clients through the complexities of investing, ensuring strategic alignment with long-term financial objectives. These methodologies empower advisors to build resilient and dynamic investment strategies, essential in today’s ever-changing financial markets.

Communication of Macro Analysis Insights to Clients

As a financial advisor, the ability to effectively communicate complex macroeconomic insights to clients is crucial. This involves more than just sharing information; it’s about making that information clear and accessible, ensuring clients feel confident and well-informed about their investment decisions.

Simplifying Complex Information: The key challenge is translating complex market data and macroeconomic trends into a format that is easily digestible for clients who may not have a deep background in finance. This might mean breaking down intricate economic concepts into simpler terms and using analogies that relate to everyday experiences. For example, you could compare market volatility to weather patterns, explaining that just as weather forecasts help us prepare for the day, economic forecasts help us prepare investment strategies.

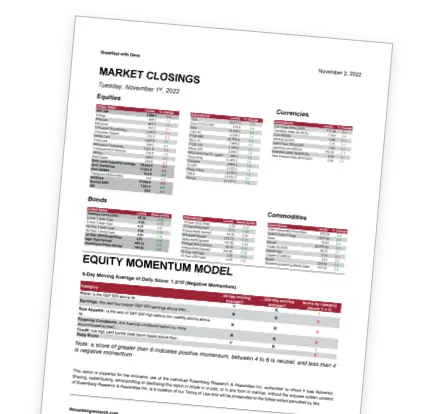

Visual Aids and Presentation: Visual aids such as charts, graphs, and infographics can be instrumental in helping clients visualize data and understand trends more effectively. These tools should be used to highlight key points and data, making complex information more engaging and easier to grasp. The use of clear, concise visuals can enhance understanding and aid in the discussion of investment strategies and market conditions.

Tailored Reporting: The personalization of reports to meet the specific needs and interests of each client is essential. Consider each client’s investment goals, industry focus, and level of financial expertise when preparing reports. For instance, clients with a keen interest in technology might benefit from a more detailed analysis of tech market trends and investment opportunities. This personalized approach not only makes the reports more relevant but also shows a deep understanding of and respect for the client’s individual perspective and needs.

Educational Initiatives: Educating clients about the importance of macroeconomic factors and their impact on investment strategies is another critical aspect of communication. This could be achieved through regular educational sessions, newsletters, or seminars that focus on demystifying economic indicators and market trends. Providing clients with knowledge and context helps them make more informed decisions and enhances their engagement with the investment process.

By focusing on these communication strategies, financial advisors can ensure that their insights on macroeconomic analysis are not only heard but understood and appreciated. This helps build a stronger advisor-client relationship based on trust and mutual understanding, ultimately leading to better-informed investment decisions. For further guidance on effective communication techniques and strategies in macroanalysis, advisors are encouraged to explore resources like Rosenberg Research’s, which offers comprehensive insights for enhancing advisory services. Check out the Rosenberg Research free trial.